Top 10 Cryptos

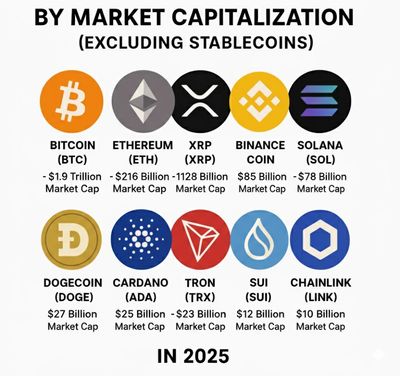

Top 10 Cryptocurrencies of 2025

The cryptocurrency landscape in 2025 features a blend of enduring giants and resilient innovators. Below are the top 10 cryptocurrencies to watch, with insights into their recent performance, fun facts, and market capitalization.

1. Bitcoin (BTC)

- Market Cap: Over $2 trillion

- Fun fact: Bitcoin’s first major price surge was in November 2013 when it surged over 450% in one month.

- 5-Year Performance: Bitcoin has delivered an average annual return of about 155% over the past five years, cementing itself as digital gold and a global store of value. Experts predict bullish scenarios with price targets ranging from $150,000 to $1 million by 2030.

2. Ethereum (ETH)

- Market Cap: Approximately $488 billion

- Fun fact: Ethereum’s upgrades in 2025, including EIP-4844, significantly improved scalability and reduced gas fees.

- 5-Year Performance: Ethereum saw consistent growth with a 5-year total return exceeding 130%, remaining the top platform for decentralized applications and DeFi.

3. Binance Coin (BNB)

- Market Cap: Around $53.6 billion

- Fun fact: BNB started as a utility token for trading fee discounts on Binance but has evolved into a pillar of DeFi and smart contracts on Binance Smart Chain.

- 5-Year Performance: BNB has grown steadily, with price and market cap increasing more than 20% yearly on average over the past five years.

4. Solana (SOL)

- Market Cap: About $110.7 billion

- Fun fact: Solana briefly surged to $257 in 2021, crashed in 2022, and rebounded strongly by 2025 due to technical upgrades boosting speeds to 10,000 TPS.

- 5-Year Performance: Highly volatile with massive growth and corrections, it shows a resilient recovery and growing institutional use in 2025.

5. XRP (Ripple)

- Market Cap: $143 billion

- Fun fact: XRP’s price surged over 36,000% during the 2017 bull run, making one of crypto’s most famous rallies.

- 5-Year Performance: Following legal challenges, XRP has stabilized with strong institutional uptake after the SEC lawsuit settlement in 2025.

6. Cardano (ADA)

- Market Cap: Estimated around $40-50 billion (based on recent data)

- Fun fact: Cardano is one of the few projects built on peer-reviewed research with a focus on sustainability and governance.

- 5-Year Performance: ADA has had steady growth with a focus on developing governance features and energy-efficient consensus.

7. Avalanche (AVAX)

- Market Cap: Roughly $30-40 billion

- Fun fact: Avalanche boasts one of the fastest consensus protocols and strong commitment to sustainability.

- 5-Year Performance: Steady rise as a scalable platform for DeFi and enterprise applications.

8. Polkadot (DOT)

- Market Cap: Around $25-30 billion

- Fun fact: Polkadot connects multiple blockchains, enabling them to interoperate seamlessly—a critical step towards a multi-chain future.

- 5-Year Performance: Solid growth driven by ecosystem expansion and cross-chain technology.

9. Dogecoin (DOGE)

- Market Cap: Approximately $15-20 billion

- Fun fact: Started as a joke, Dogecoin has a strong community and was one of the first cryptos accepted for retail payments.

- 5-Year Performance: Volatile but popular with significant retail investor interest; retains a niche as a speculative asset.

10. Shiba Inu (SHIB)

- Market Cap: Around $8-10 billion

- Fun fact: SHIB has evolved from a meme coin to a token with growing ecosystem projects like Shibarium.

- 5-Year Performance: High volatility and speculative growth, with risks correlated to meme coin sentiment.

Top Ten Cryptos 2025

High Growth Crypto Countries

Crypto Friendly Countries

United Arab Emirates

The UAE is one of the most crypto-friendly countries in 2025. It has clear rules and strong support from regulators like the Virtual Assets Regulatory Authority (VARA) in Dubai. Crypto businesses must get licenses, which helps keep things safe and trustworthy. The UAE also has no personal tax on crypto gains. New rules starting in 2025 require crypto firms to report details about customers and transactions to tax authorities, making the market more transparent. This setup attracts many big crypto companies and helps the country grow as a major crypto hub.

Singapore

Singapore has a balanced approach to crypto. It encourages innovation but also protects investors by requiring licenses for crypto exchanges and services. There is no capital gains tax on cryptocurrencies for individuals, which makes it attractive for investors. The Monetary Authority of Singapore (MAS) actively monitors the market and updates rules to keep up with changes in the crypto world, ensuring a stable and reliable environment for businesses and users alike.

Hong Kong

Hong Kong is quickly becoming a leading crypto hub. The government has introduced clear laws around digital assets and stablecoins, aiming to support safe growth of the crypto sector. New policies help attract global crypto companies and investors by providing a regulated but friendly market. These efforts have boosted Hong Kong’s status as a top place for crypto trading and innovation in Asia.

Germany

Germany has well-defined regulations for cryptocurrencies. The country treats crypto as private money, and there are rules for tax reporting and investor protections. Crypto businesses must follow strict laws to prevent money laundering, making Germany a secure place to operate in the crypto space. This clear framework supports growth while safeguarding users and companies.

Switzerland

Switzerland is famous for being very open to crypto, especially in Zug, known as “Crypto Valley.” The country offers low taxes on long-term crypto gains and has a welcoming environment for startups and blockchain projects. Swiss regulators have established clear guidelines, giving businesses and investors confidence to innovate without heavy restrictions.

Australia

Australia has developed better crypto regulations to balance protection and innovation. The Australian government requires crypto exchanges to register and follow anti-money laundering rules. While there are taxes on crypto gains, the regulations are clear, helping both investors and businesses understand their responsibilities. Australia’s legal framework encourages growth while keeping the market safe for everyone.

USA

53 million people in the USA own crypto. The United States has become much more crypto-friendly in 2025. The government recently passed the GENIUS Act, its first major national law for cryptocurrency, which sets clear rules for stablecoins and how they should be backed. This new law aims to make things fair and consistent for everyone across the country, helping both businesses and regular people feel safe using crypto. Federal regulators like the SEC and CFTC are now working together, making it easier for crypto companies to launch new products and for exchanges to handle digital assets. These changes mean the US is now more open to innovation in crypto, supporting new ideas while protecting users at the same time

Copyright © 2025 All Rights Reserved. CRYPTO OWL - crypto done wisely. Crypto Owl - Your Lifelong Crypto Companion

- Risk Statement

- About Us

- Start Buying Crypto

- Top 10 Cryptos

- CRYPTO 100

- Crypto Wallets

- Crypto Owl Gift Card

- Crypto Child Trust Funds

- Crypto ISAs

- Crypto Regular Savings

- Crypto Pensions SIPPS

- Crypto Owl Debit Card

- Stablecoins

- Bitcoin

- Ethereum

- Solana

- Avalanche

- Crypto Loans

- Real World Assets

- Meme Coins

- DeFi

- DEX

- AI Crypto

- Top Crypto Countries